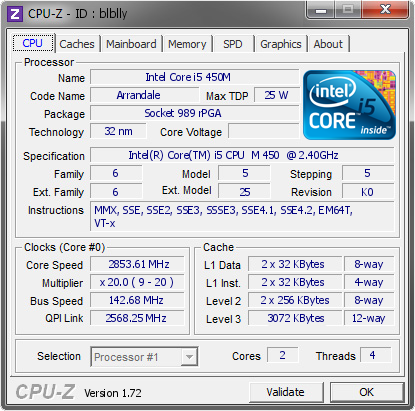

Processore Intel core I5 450M i5 450M 3M Cache 2.4 GHz Taccuino Del Computer Portatile Cpu Processore I5-450M può lavoro _ - AliExpress Mobile

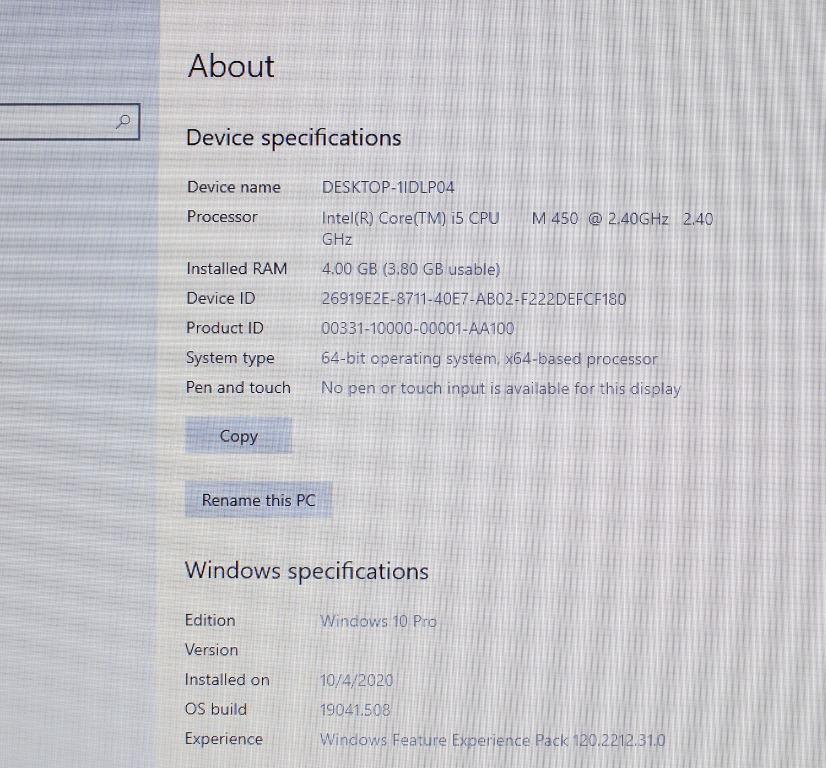

HP PROBOOK 450 G0 15,6 in computer portatile i3-3120M 2,50 GHz 4 GB 500 GB disco rigido Windows 10 EUR 1,39 - PicClick IT

Refurbished - Dell Latitude E7440, 14” FHD Laptop, Intel Core i5-4300U @ 1.90 GHz, 16GB DDR3, NEW 500GB M.2 SSD, Bluetooth, Webcam, Win10 Pro 64 | Walmart Canada

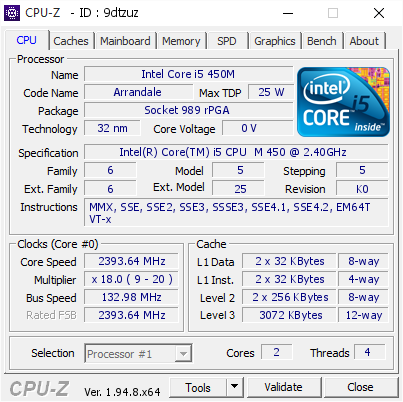

HP Pavilion dv6 -3033cl Intel Core i5 M450 @ 2.40GHz 4GB RAM 250GB HDD 1366×768 – ASA College: Florida

Originale Intel core del Processore I5 450M 3M Cache 2.4 GHz Taccuino Del Computer Portatile Processore Cpu Trasporto Libero di I5-450M - AliExpress

Z Galaxy Center - HP Laptop ON SALE.. . HP Pavilion dm4 Notebook PC Intel(R) Core(TM) i5 CPU M 450 @2.40GHz (4CPUs), ~2.4GHz RAM : 2048MB HDD : 500GB AMD Radeon Graphics

Which generation of 'Intel Core i5 520m' processor is? If it's transistors are 34nm I guess, please provide some information. - Quora

WIN10 NEC VALUESTAR 一体型PC PC-VN770BS6B CPU Core i5 M450 2.40GHz メモリ4GB HDD240GB(モニタ一体型)|売買されたオークション情報、ヤフオク! の商品情報をアーカイブ公開 - オークファン(aucfan.com)

Originale Intel Core I5 450 m CPU 2.40 ghz 3 m Dual-Core del processore Del Computer Portatile I5-450M la nave libera Il Trasporto fuori entro 1 giorno

LG Core i5 15.6" laptop (i5-M450, 4G Ram, 320G HDD), Computers & Tech, Laptops & Notebooks on Carousell

HP ProBook 6550B Intel (R) Core (TM) i5 CPU M 450 @ 2.40GHZ 2GB RAM 300GB W10P QWERTY US WD698ET#ABH-QPV7 - BVA Auctions - online veilingen

Open Box: HP Laptop Pavilion Intel Core i5 1st Gen 450M (2.40GHz) 4GB Memory 500GB HDD Intel HD Graphics 15.6" Windows 7 Home Premium 64-bit DV6-3033CL - Newegg.com