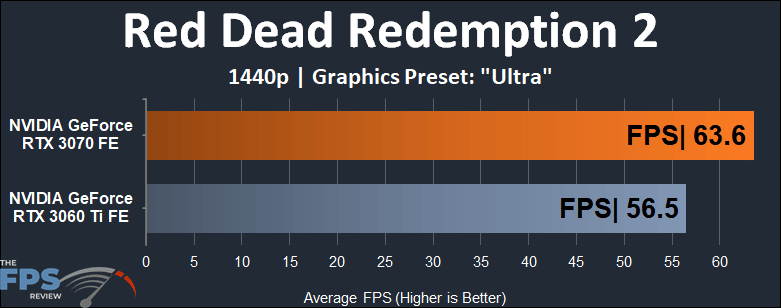

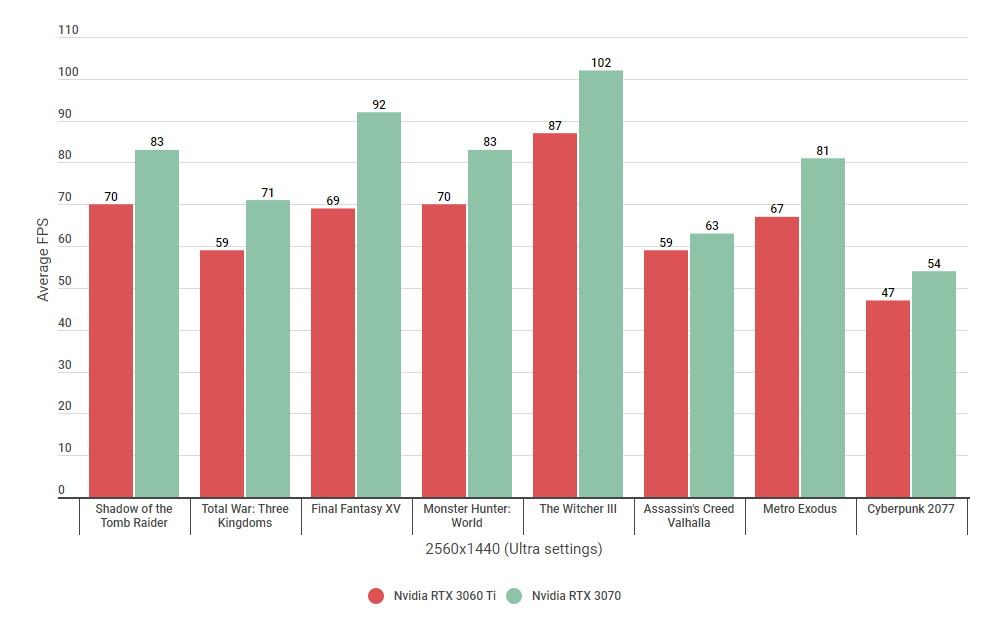

RTX 3060 Ti vs RTX 3070 Benchmark delle prestazioni di gioco (Core i9-10900K vs Core i9-10900K) - GPUCheck Italy / Italia

Sostituzione ventola scheda grafica RTX3070 per ASUS GeForce RTX 3070 3060 Ti megodon GAMING GPU ventola di raffreddamento _ - AliExpress Mobile

MSI NVIDIA GEFORCE GTX RTX 3090/3060 TI / 3070/3080 Gams Gaming Card Video Card Video Da 614,5 € | DHgate