LongLife Magnesium 375® | 5 sali di magnesio | Alto dosaggio | Integratore magnesio antistress | 100 tavolette rivestite | Oltre 3 mesi di trattamento | Senza glutine : Amazon.it: Salute e cura della persona

LongLife Magnesium 375® | 5 sali di magnesio | Alto dosaggio | Integratore magnesio antistress | 100 tavolette rivestite | Oltre 3 mesi di trattamento | Senza glutine : Amazon.it: Salute e cura della persona

Amazon.it:Recensioni clienti: LongLife Magnesium 375® | 5 sali di magnesio | Alto dosaggio | Integratore magnesio antistress | 100 tavolette rivestite | Oltre 3 mesi di trattamento | Senza glutine

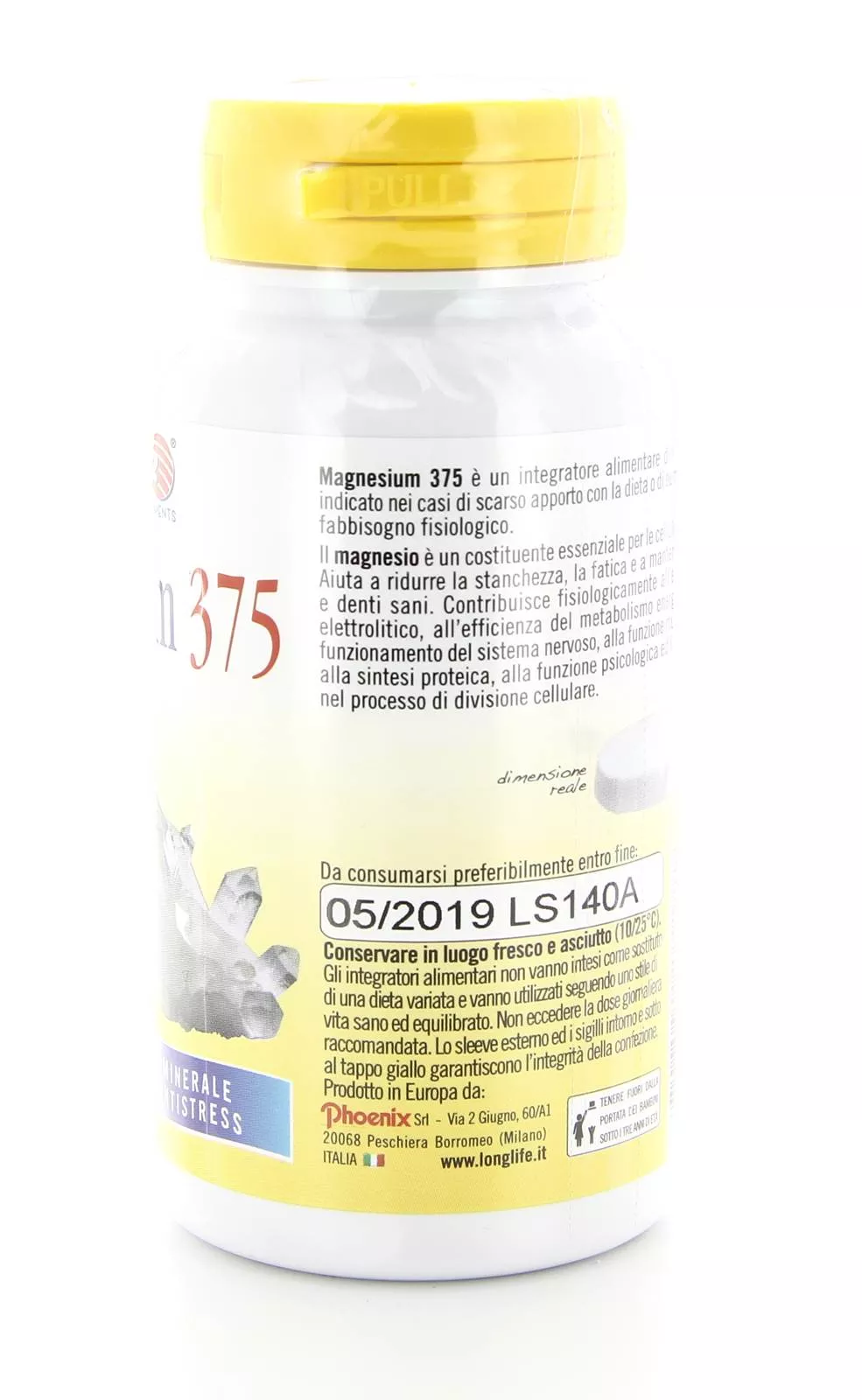

LongLife Magnesium 375® | 5 sali di magnesio | Alto dosaggio | Integratore magnesio antistress | 100 tavolette rivestite | Oltre 3 mesi di trattamento | Senza glutine : Amazon.it: Salute e cura della persona

Longlife Magnesium 375 Fizz Integratore di magnesio gusto limone 20 compresse effervescenti | Amica Farmacia

Amazon.it:Recensioni clienti: LongLife Magnesium 375® | 5 sali di magnesio | Alto dosaggio | Integratore magnesio antistress | 100 tavolette rivestite | Oltre 3 mesi di trattamento | Senza glutine

LongLife Magnesium 375® Powder | Integratore di magnesio citrato in polvere | Gusto limone | Senza glutine e vegano : Amazon.it: Salute e cura della persona